FREEDOM LIVESTREAMS WILL TRANSFORM YOUR LIFE

Freedom Livestreams is an all-ecompassing academy, offering comprehensive education in forex trading, stocks, real estate, credit repair, and personal growth.

FREEDOM LIVESTREAMS WILL TRANSFORM YOUR LIFE

Freedom Livestreams is an all-ecompassing academy, offering comprehensive education in forex trading, stocks, real estate, credit repair, and personal growth.

Worlds Only Always Free Trading offers a groundbreaking trading platform for easy, anytime, anywhere trading.

Our Platform Provides Access to a Wide Range of Financial Markets, Including:

STOCKS

CRYPTO

FOREX

REAL ESTATE INVESTING

TRADING IDEAS

BUSINESS FINANCING

Worlds Only Always Free Trading offers a groundbreaking trading platform for easy, anytime, anywhere trading.

Our Platform Provides Access to a Wide Range of Financial Markets, Including:

STOCKS

CRYPTO

AI BOTS

FOREX

REAL ESTATE INVESTING

CREDIT REPAIR

TRADING IDEAS

BUSINESS FINANCING

ADDITIONAL

COURSES

PERSONAL LOANS

TRADING PLAN

NETWORKING AND COLLABORATIONS

RISK MANAGEMENT STRATEGIES

ADDITIONAL

COURSES

PERSONAL LOANS

TRADING PLAN

NETWORKING AND COLLABORATIONS

RISK MANAGEMENT STRATEGIES

Freedom Livestreams Will Transform Your Life

Whether you're a beginner seeking fundamental knowledge or an experienced individual aiming to refine your skills, Freedom Livestreams aims to be a guide on your journey to financial literacy and self-improvement.

Our Experts Share

Valuable Insights

Tips

Strategies

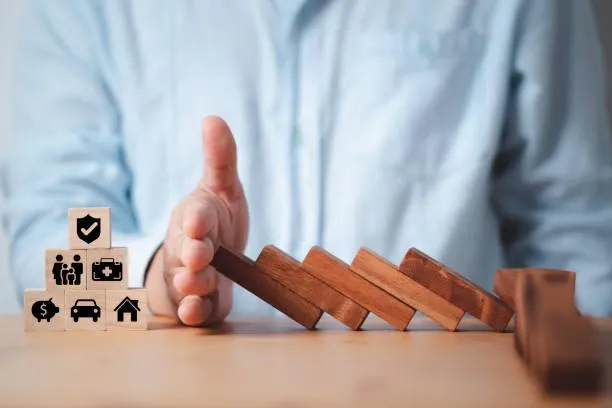

Protecting Your Wealth: Insurance and Risk Management

"Secure your wealth and future with smart insurance and risk management. Trust Freedom Livestreams to guide you."

In today's unpredictable world, safeguarding your wealth is more important than ever. Whether it's through smart insurance choices or effective risk management strategies, protecting your assets can provide peace of mind and ensure financial stability. Freedom Livestreams is here to guide you through this essential process.

Understanding Insurance

Insurance is a critical component of wealth protection. It acts as a safety net, covering potential losses and helping you recover from unexpected events. Here are a few key types of insurance everyone should consider:

Health Insurance: Protects against medical expenses, ensuring you receive the care you need without draining your savings.

Life Insurance: Provides financial support to your loved ones in case of your untimely death, ensuring they are taken care of.

Property Insurance: Covers damage to your home or other property, protecting you from the high costs of repairs or replacements.

Auto Insurance: Required by law in most places, it covers accidents and damage to your vehicle, minimizing out-of-pocket expenses.

Effective Risk Management

Beyond insurance, risk management involves identifying potential threats to your wealth and taking steps to mitigate them. Here are some strategies:

Diversify Investments: Spread your investments across different asset classes to reduce risk. This way, if one investment underperforms, others may offset the loss.

Emergency Fund: Maintain a fund that can cover 3-6 months of living expenses. This buffer can help you navigate unexpected financial setbacks without resorting to high-interest debt.

Regular Reviews: Periodically review your financial situation and insurance coverage to ensure they align with your current needs and risks.

How Freedom Livestreams Can Help

At Freedom Livestreams, we understand that managing risk and insurance can be daunting. Our expert team is dedicated to helping you navigate these complexities and build a robust protection plan tailored to your unique needs. Here’s how we can assist:

Personalized Advice: We assess your financial situation and provide customized recommendations on the types and levels of insurance coverage you need.

Risk Assessment: Our team conducts thorough risk assessments to identify potential threats to your wealth and develop strategies to mitigate them.

Education and Resources: We offer educational materials and resources to help you understand insurance and risk management better, empowering you to make informed decisions.

Conclusion

Protecting your wealth through insurance and effective risk management is essential for long-term financial stability. With the guidance of Freedom Livestreams, you can create a comprehensive plan that safeguards your assets and provides peace of mind. Don’t leave your financial future to chance—take proactive steps today to protect what you’ve worked so hard to build.

Freedom Livestreams Will Transform Your Life

Whether you're a beginner seeking fundamental knowledge or an experienced individual aiming to refine your skills, Freedom Livestreams aims to be a guide on your journey to financial literacy and self-improvement.

Our Experts Share

Valuable Insights

Tips

Strategies

Copyright © 2023 Freedom LiveStream All rights reserved.

Copyright © 2023 Freedom LiveStream All rights reserved.